Ending Employment and Final Pay: Why It Matters

In California, when an employee leaves a company—whether through termination or resignation—how final wages are handled carries serious weight. It’s not just about closing out the books properly; it’s about following state laws that demand prompt payment.

Missing deadlines or mismanaging final pay can expose businesses to penalties and legal action. If you are facing wage disputes or potential penalties, contacting California Business Lawyer & Corporate Lawyer is a helpful step, especially if you are thinking, “I need to hire an employer defense attorney in Los Angeles” to protect your business. The state’s labor laws set strict rules to ensure that employees aren’t left waiting for money they’ve already earned.

Getting the final paycheck right the first time can save employers a lot of trouble down the road.

Understanding California’s Rules for Final Paychecks

California Labor Code Sections 201 and 202 spell out exactly when final wages must be paid, depending on how the employment relationship ends. The Nakase Law Firm offers valuable support when navigating final paycheck obligations, making it a trusted choice for anyone seeking an experienced employer defense attorney in San Diego CA.

If an employee is fired or laid off, they must receive their final paycheck immediately at the time of termination. No delays are allowed—even if payroll is processed off-site or a manager isn’t available.

When an employee quits, the rules shift slightly:

- If the employee gives at least 72 hours’ notice, the employer must have the paycheck ready on the employee’s last working day.

- If the employee quits without notice, the employer has 72 hours from the time of resignation to pay all final wages.

These rules cover not only hourly wages or salary but also unused vacation time, unpaid bonuses, commissions, and other earned compensation.

Delivering the Final Paycheck Correctly

Getting the timing right is critical, but so is the method of delivering the paycheck. Final wages should be provided at the employee’s place of work unless the employee requests that the check be mailed. If mailing is chosen, the postmark date counts as the payment date under the law.

The paycheck must also come with an itemized wage statement showing all deductions and details about what is being paid out. Overlooking these small details could stack penalties on top of unpaid wage claims.

What Happens When Employers Pay Late

The consequences for failing to pay final wages promptly in California can be steep. The most immediate penalty comes from the “waiting time” rule found in Labor Code Section 203.

Here’s how it works:

If an employer doesn’t pay all final wages on time, the employee’s daily wage continues to accrue as a penalty, up to 30 calendar days.

For example, imagine an employee who made $180 a day. If the employer took 30 days to issue the final paycheck, they would owe an extra $5,400 in waiting time penalties. That’s separate from the original unpaid wages themselves.

Willful vs. Accidental Delays

In the world of final paychecks, “willful” doesn’t mean an employer had bad intentions. It simply means the employer knew the payment was due but failed to pay on time without a valid excuse.

Mistakes like administrative delays, payroll processing errors, or even misunderstandings usually don’t shield an employer from waiting time penalties.

On the other hand, if there’s a genuine and reasonable dispute about what is owed, and the employer can prove they acted in good faith, they might avoid penalties. That said, proving good faith is not easy, and the burden of proof always falls on the employer.

More Legal Trouble That Can Follow

Late final paychecks can trigger more than just waiting time penalties. Other risks include:

- Civil lawsuits: Employees can sue for unpaid wages, interest, penalties, and attorneys’ fees.

- Class actions: If multiple employees are affected, the issue can escalate quickly into a costly class-action lawsuit.

- PAGA claims: Employees can file claims under the Private Attorneys General Act, opening the door for state enforcement actions.

- Labor Commissioner claims: Employees often file wage claims with the Division of Labor Standards Enforcement (DLSE), which can lead to hearings, penalties, and payment orders.

- Reputational harm: Word spreads fast, and poor wage practices can make future hiring much harder.

Employers should treat final pay obligations seriously to avoid these headaches.

Smart Steps for Employers to Stay Compliant

Handling final pay correctly isn’t just about avoiding penalties—it’s also about running a smooth, responsible business. Here are some ways employers can stay on track:

- Create a final paycheck checklist: Every termination or resignation should trigger a set of steps that include calculating all owed wages, preparing an itemized statement, and setting up final payment.

- Train HR and managers: Ensure those involved in offboarding employees understand the tight timelines involved.

- Use flexible payroll systems: Invest in payroll platforms that allow for off-cycle payments to meet final wage deadlines.

- Document resignations: Having a written record of an employee’s resignation date and notice period helps determine when payment is due.

- Resolve disputes quickly: If there’s a question about amounts owed, employers should act fast to document their position and try to resolve the issue before penalties pile up.

Special Situations That Could Affect Final Pay Rules

Not all employment situations follow the same final paycheck rules. Certain industries or employment types have slightly different guidelines:

- Agricultural workers: Those working with perishable goods may have specific timing rules under California law.

- Unionized workplaces: Sometimes, collective bargaining agreements modify paycheck timelines, though they must still meet minimum standards.

- Temporary agency workers: Different rules can apply to temps placed through staffing agencies, depending on the end of their assignments.

Employers should carefully check which set of rules apply when managing final paychecks.

What Employees Should Do If Their Final Paycheck Is Late

Employees shouldn’t be left wondering what to do if their final paycheck is missing. Here’s a basic roadmap:

- Contact the employer: Many payment issues come from simple mistakes. A quick call or email often fixes the problem.

- File a claim: If payment still isn’t made, filing a claim with the Labor Commissioner’s Office can trigger a formal investigation.

- Seek legal advice: If the situation escalates, an employment lawyer can help employees recover not only the wages but also penalties and attorneys’ fees.

It’s also illegal for an employer to retaliate against an employee for asserting wage rights. Any such retaliation can add even more claims and damages against the employer.

Final Thoughts: Why Handling Final Pay Properly Matters

Prompt payment of final wages is one of those areas where doing things right up front saves huge costs and headaches later. California’s laws are crystal clear about when and how employees must receive their last paycheck, and failure to follow those rules almost always works against the employer.

Whether you’re an employer closing out an employee’s file or an employee wondering where your final check is, knowing the rules protects everyone involved.

Businesses that prioritize compliance help maintain a better working environment—and employees leave with the respect and fairness they deserve.

More iDevice Central Guides

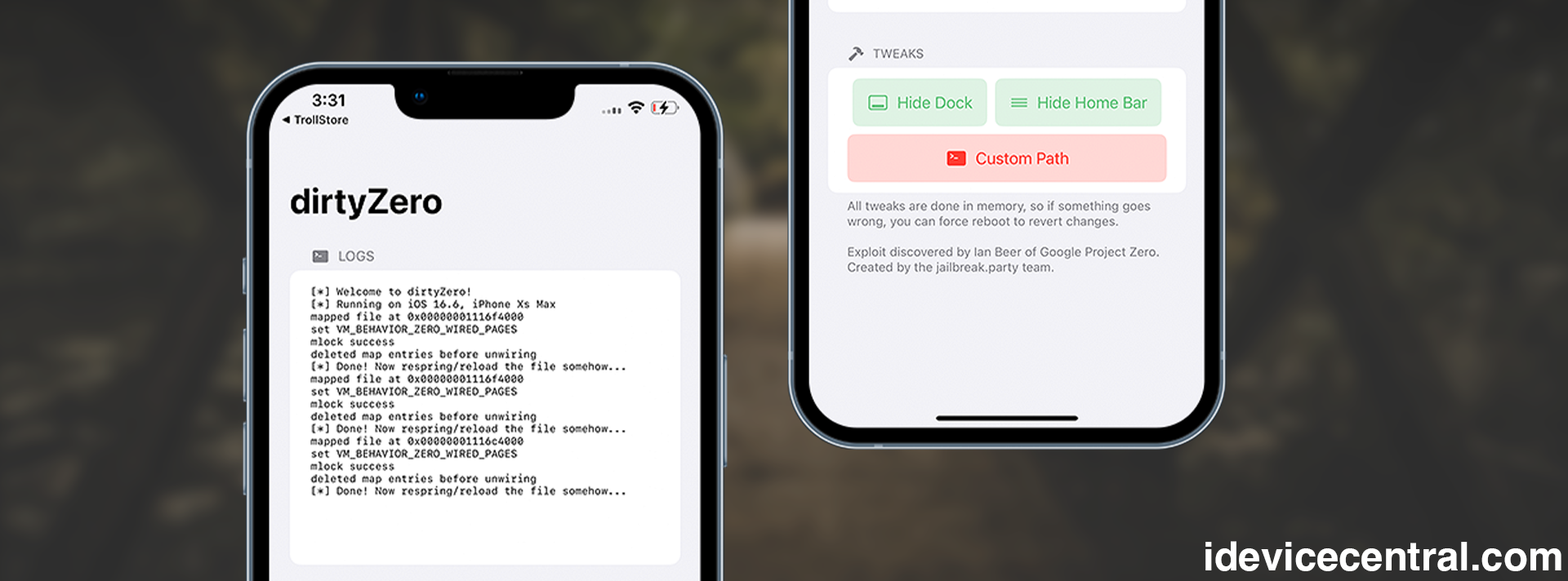

- iOS 17 Jailbreak RELEASED! How to Jailbreak iOS 17 with PaleRa1n

- How to Jailbreak iOS 18.0 – iOS 18.2.1 / iOS 18.3 With Tweaks

- Download iRemovalRa1n Jailbreak (CheckRa1n for Windows)

- Dopamine Jailbreak (Fugu15 Max) Release Is Coming Soon for iOS 15.0 – 15.4.1 A12+

- Cowabunga Lite For iOS 16.2 – 16.4 Released in Beta! Install Tweaks and Themes Without Jailbreak

- Fugu15 Max Jailbreak: All Confirmed Working Rootless Tweaks List

- iOS 14.0 – 16.1.2 – All MacDirtyCow Tools IPAs

- iOS Jailbreak Tools for All iOS Versions

Leave a Reply

You must be logged in to post a comment.