Fintech, or financial technology, refers to the use of technology in the financial services industry to provide innovative solutions for traditional financial activities. Fintech companies are disruptors, reimagining how financial services are delivered and consumed.

As technology continues to advance, the business landscape is constantly evolving. The rise of fintech is transforming the industry, providing companies with new ways to do business, improve their operations, and reach new customers.

Fintech development is not just a trend; it is a strategic tool for business scaling. Companies that embrace fintech solutions can benefit from improved financial management, enhanced customer experience, access to new markets and customer segments, cost efficiency, and increased profitability.

Understanding Fintech Development

Key components of fintech

Payment processing: Payment processing is the cornerstone of fintech. Fintech solutions aim to make payment processing faster, more secure, and more convenient for businesses and consumers alike. Payment apps, e-wallets, and mobile banking are some examples of fintech payment processing solutions.

Digital banking: Digital banking solutions aim to provide customers with a better banking experience through mobile and online banking platforms. These platforms offer features such as real-time account monitoring, mobile check deposits, and bill payments.

Blockchain and cryptocurrencies: Blockchain technology and cryptocurrencies are gaining popularity in the fintech industry as they aim to provide faster, more secure transactions while removing the need for intermediaries.

Lending platforms: Fintech lending platforms offer alternative sources of credit for consumers and small businesses. These platforms use innovative risk assessment and underwriting models to provide more personalized loans quickly and easily.

Insurance: Insurtech solutions utilize technology to simplify and improve the insurance industry. These solutions aim to provide personalized insurance products and services while reducing the costs associated with traditional insurance carriers.

The role of technology in fintech

Fintech solutions rely on cutting-edge technology to be effective. Some of the core technologies that enable fintech development include:

AI and machine learning: AI and machine learning are used in fintech solutions to automate tasks, predict customer behavior, and improve the overall customer experience.

Big data analytics: Big data analytics is used to analyze customer data, create predictive models, and identify new growth opportunities.

Cloud computing: Cloud computing allows for the storage and processing of large data sets and enables real-time performance for fintech solutions.

Cybersecurity measures: Cybersecurity is a critical component of fintech solutions. Advanced security measures are necessary to protect against cyberattacks and ensure customer data is secure.

These fintech development services and technologies together form the backbone of modern financial technology, enabling businesses to scale efficiently and effectively.

Benefits of Fintech Development for Business Scaling

Improved financial management

Fintech solutions provide businesses with the tools to better manage their finances. Real-time data and analytics allow for more informed decision-making, while streamlined financial operations reduce administrative costs and increase efficiency.

Enhanced customer experience

Fintech solutions enable businesses to offer personalized services and faster transaction processing, leading to an enhanced customer experience.

Access to new markets and customer segments

Fintech solutions can help companies expand their market reach through digital platforms. These platforms allow businesses to access customers globally and include underserved populations who may not have previously had access to financial services.

Cost efficiency and increased profitability

Fintech solutions can reduce operational costs through automation and improved efficiency, leading to increased profitability.

Strategic Implementation of Fintech Solutions

Assessing business needs and goals

Before implementing fintech solutions, businesses must identify their needs and goals. Fintech solutions should align with a company’s strategic objectives and provide a clear return on investment.

Choosing the right fintech solutions

When choosing a fintech solution, companies must consider factors such as integration with existing systems, scalability, and flexibility. The selected fintech solutions should be able to grow with the business and adapt to changing needs.

Developing a fintech roadmap

Developing a clear roadmap for fintech implementation is critical to its success. Short-term and long-term objectives should be identified, and key performance indicators should be established to measure progress.

Collaborating with fintech partners

Collaborating with fintech partners can help businesses access innovative solutions quickly and effectively. Fintech startups and innovation hubs can help companies identify new solutions, while established financial institutions and technology providers can offer more comprehensive services.

Case Studies: Successful Fintech Implementation

Company A: Transforming payment processing

Company A, a global e-commerce company, was struggling with high processing fees and lengthy payment processing times. They partnered with a fintech startup that offered a low-cost payment processing solution with real-time processing. By implementing the fintech solution, Company A was able to reduce payment processing times by 50% and save over 30% on processing fees.

Company B: Enhancing customer experience through digital banking

Company B, a regional bank, wanted to improve its customer experience by offering mobile banking services. They partnered with a fintech provider to launch a mobile banking app that offered features such as mobile check deposit and real-time account monitoring. As a result, Company B saw a 25% increase in mobile banking users and an increase in customer satisfaction.

Company C: Expanding market reach with blockchain technology

Company C, a small business lender, wanted to expand its market reach by offering loans to customers globally. They partnered with a fintech company that offered blockchain-based lending solutions, allowing them to lend money internationally and remove intermediaries in the lending process. By implementing the fintech solution, Company C was able to reduce lending fees and expand its reach to new markets.

Challenges and Considerations in Fintech Development

Regulatory compliance

Navigating financial regulations is a key challenge in fintech development. Companies must ensure they are complying with regulations while also delivering innovative solutions to customers.

Technology integration

Integrating fintech solutions with existing systems can be challenging, particularly in the case of legacy systems. Technical support and maintenance can also be a concern for companies implementing fintech solutions.

Risk management

Identifying potential risks and developing mitigation strategies is critical to the successful implementation of fintech solutions. Businesses must consider factors such as cybersecurity and data privacy when implementing fintech solutions.

Change management

Employee training and adaptation, as well as managing customer expectations, can also be challenging when implementing fintech solutions.

Future Trends in Fintech Development

The rise of decentralized finance (DeFi)

DeFi is a term used to describe the movement toward decentralized financial systems, which rely on blockchain technology and cryptocurrencies. DeFi aims to create a more open and transparent financial system by removing intermediaries.

Growing importance of artificial intelligence

AI is becoming increasingly important in fintech development, particularly in customer service and underwriting processes. AI can help automate tasks, improve the customer experience, and reduce risk.

Expansion of embedded finance

Embedded finance refers to the integration of financial services into non-financial applications. This allows for a seamless customer experience, with financial services integrated into everyday products and services.

The impact of 5G on fintech solutions

5G technology is expected to enhance the performance of fintech solutions, particularly those that rely on real-time processing.

Conclusion

Fintech development is not just a trend; it is a strategic tool for business scaling. Companies that embrace fintech solutions can benefit from improved financial management, enhanced customer experience, access to new markets and customer segments, cost efficiency, and increased profitability.

Fintech solutions offer businesses numerous benefits, but successful implementation requires a strategic approach.

Companies must identify their needs and goals, choose the right fintech solutions, develop a fintech roadmap, and collaborate with fintech partners effectively.

As technology continues to advance, businesses must embrace fintech solutions to stay competitive. Fintech development offers companies new opportunities for growth, improved efficiency, and increased profitability. Companies that lag behind risk being left behind.

More iDevice Central Guides

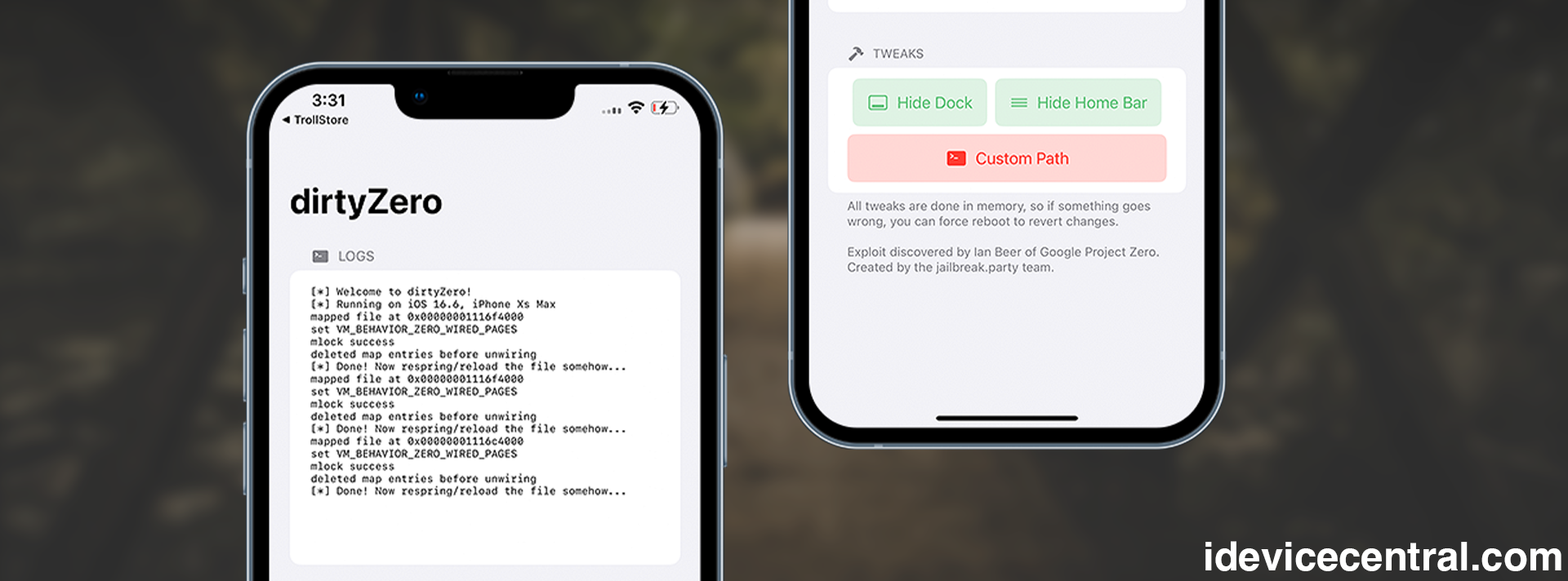

- iOS 17 Jailbreak RELEASED! How to Jailbreak iOS 17 with PaleRa1n

- How to Jailbreak iOS 18.0 – iOS 18.2.1 / iOS 18.3 With Tweaks

- Download iRemovalRa1n Jailbreak (CheckRa1n for Windows)

- Dopamine Jailbreak (Fugu15 Max) Release Is Coming Soon for iOS 15.0 – 15.4.1 A12+

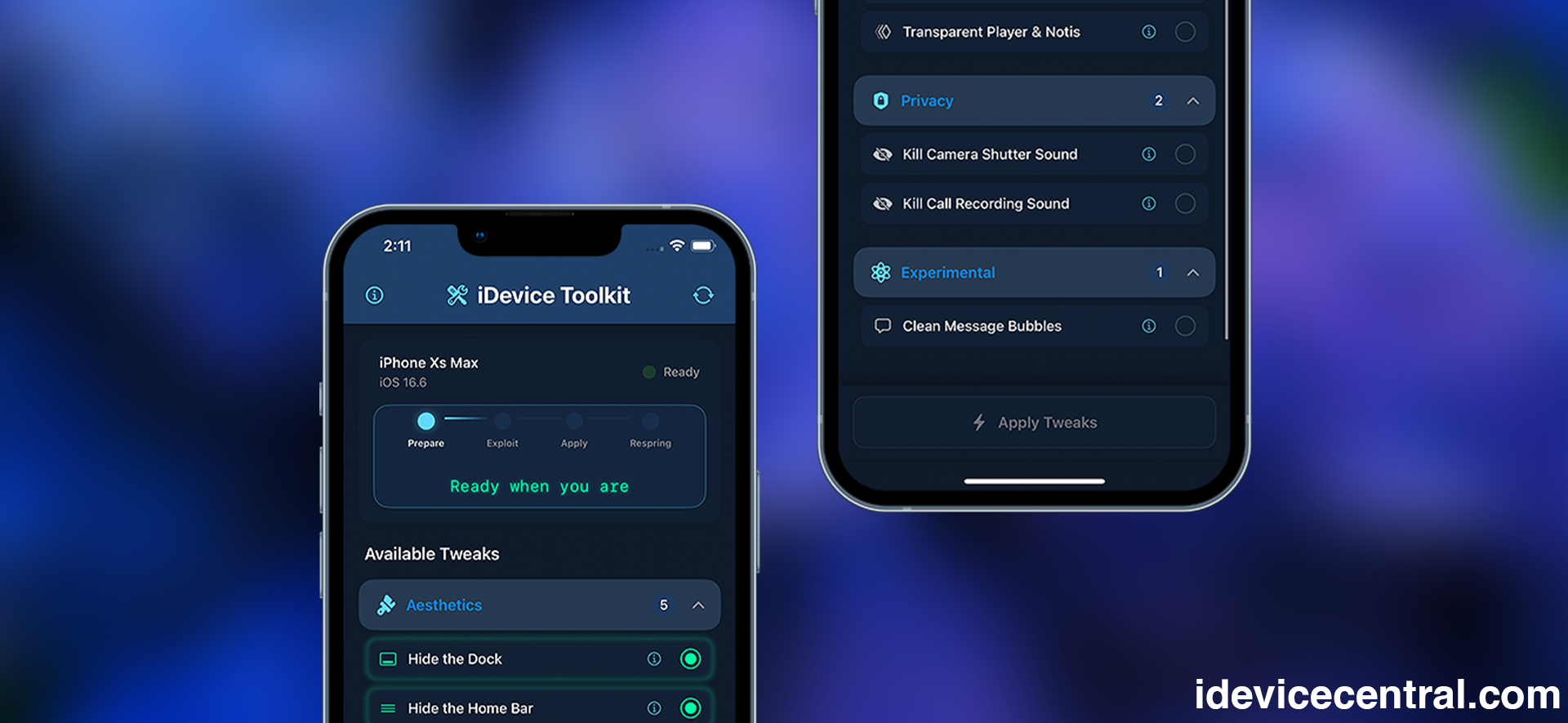

- Cowabunga Lite For iOS 16.2 – 16.4 Released in Beta! Install Tweaks and Themes Without Jailbreak

- Fugu15 Max Jailbreak: All Confirmed Working Rootless Tweaks List

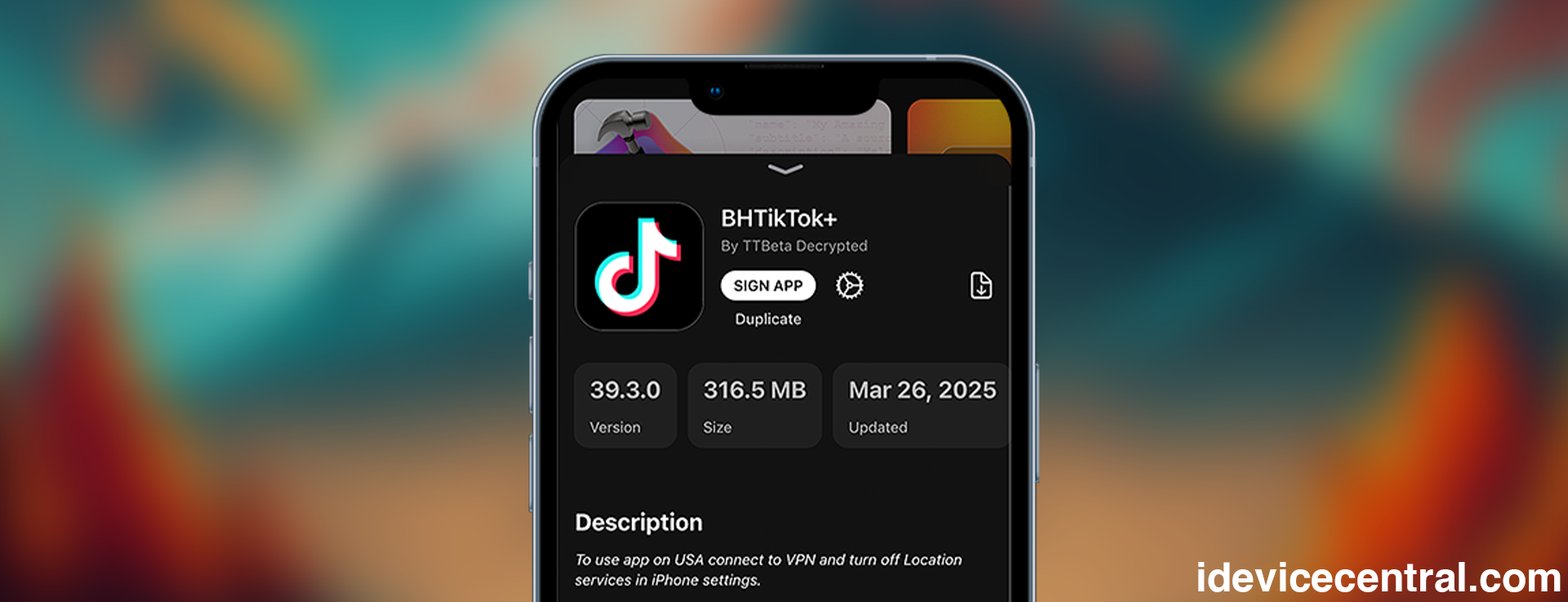

- iOS 14.0 – 16.1.2 – All MacDirtyCow Tools IPAs

- iOS Jailbreak Tools for All iOS Versions

Leave a Reply

You must be logged in to post a comment.